In today’s digital transformation age, banks that want to stay ahead of the competition must focus on optimising their operations beyond customer-facing digital services, like mobile banking and payments.

After all, upgrading behind-the-scenes infrastructure and processes can be key to achieving cost savings and a competitive advantage.

In fact, Artificial Intelligence (AI) and cloud computing-powered digital technologies can transform financial institutions’ operations by automating manual management tasks and enabling greater collaboration in correspondent banking.

To understand the role of technology in trade finance and correspondent banking, in this blog post, we’ll explore the key modules of Globit’s RISQ FI solution. We’ll also demonstrate how it can help your financial institution overcome pressing challenges, such as achieving a real-time, bank-wide view of your operations and a digitalized, recorded decision-making process.

Read on for a comprehensive guide to the future of correspondent banking and how RISQ FI can help your financial institution to keep up with the digital transformation in banking.

RISQ FI is the first end-to-end solution dedicated to financial institutions, allowing for the control and monitoring of correspondent-wide limits across all divisions, as well as onboarding new financial counterparties and servicing ongoing credit lines.

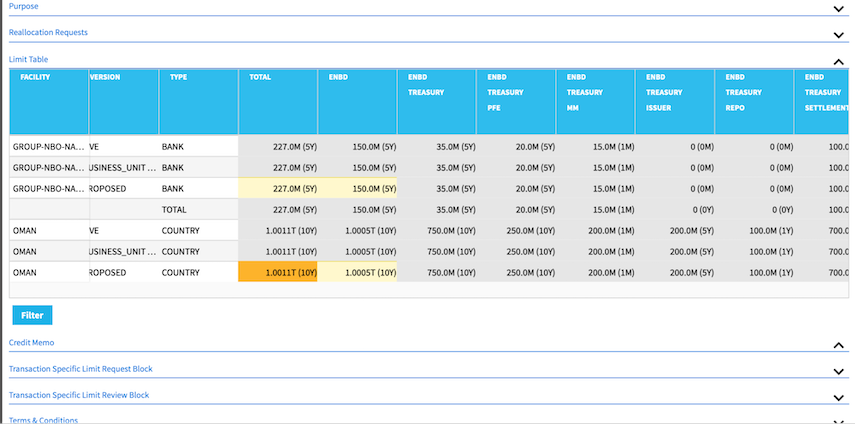

The solution covers all operational processes related to financial institutions, such as global limit allocation, earmarking (blocking) credit lines for trades in the pipeline, reallocation of lines in case of limit shortages, and servicing of credit lines, including interim, annual reviews, termination or extension of lines.

With RISQ FI, banks can respond to customer requests faster and obtain full visibility of the entire credit pipeline and exposures. Also, it optimises limit utilisation, leading to regulatory cost savings.

All these factors add up to the ultimate digital trade finance and correspondent banking solution.

Let’s explore the functionality of Globit RISQ FI before diving into its modules. RISQ FI is a user-friendly, web-based application accessible via any browser. Its intuitive UX design follows contemporary application patterns, allowing users to easily navigate and access information.

A mobile-optimised page set provides quick access to daily activities, such as approving transactions or monitoring limits, while administrative functions are only accessible via desktop or tablet browsers.

With a flexible workflow engine, RISQ FI gives its users access to a to-do list on their homepage, which they can follow to complete their tasks. Additionally, users can respond to emails with a specific format, triggering actions on the workflow. This functionality offers greater flexibility and convenience, allowing users to complete tasks efficiently and effectively.

Exciting interface functions of RISQ FI also include a Google-like search, enabling users to search for real-time data (counterparty, limit, transaction, etc.) and take action on it.

The embedded chat functionality allows users to communicate about limit setup processes or reservation workflows, and chat messages are kept in the system and tagged to the associated data to preserve institutional memory.

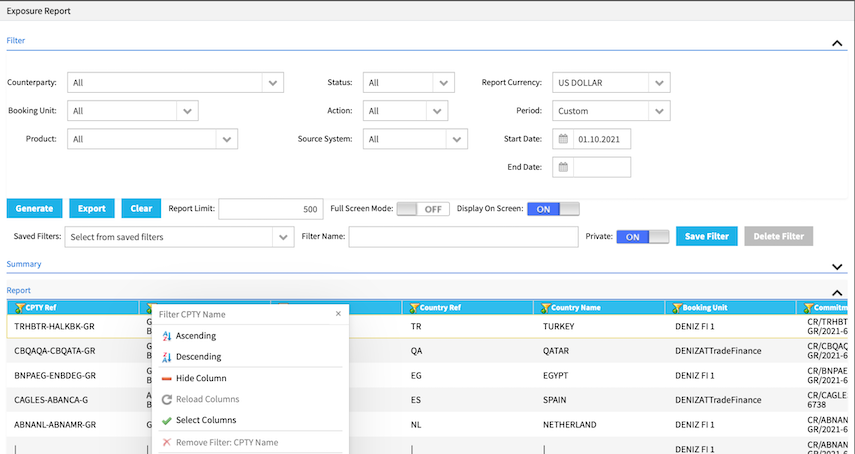

Furthermore, the solution provides Excel-like filtering and sorting capabilities on all lists and tables, and data can be exported to Excel.

Globit RISQ FI is a solution that has evolved over the course of 10 years. It has been developed based on customer requirements, suggestions, and know-how and approved by local regulators.

With these improvements, the solution currently addresses all the needs of the financial institution divisions of banks in four modules.

Limit Management is one of the four modules offering several sub-features to enhance limit-setting processes, such as template management, origination and rating modules, and transaction-specific limit management.

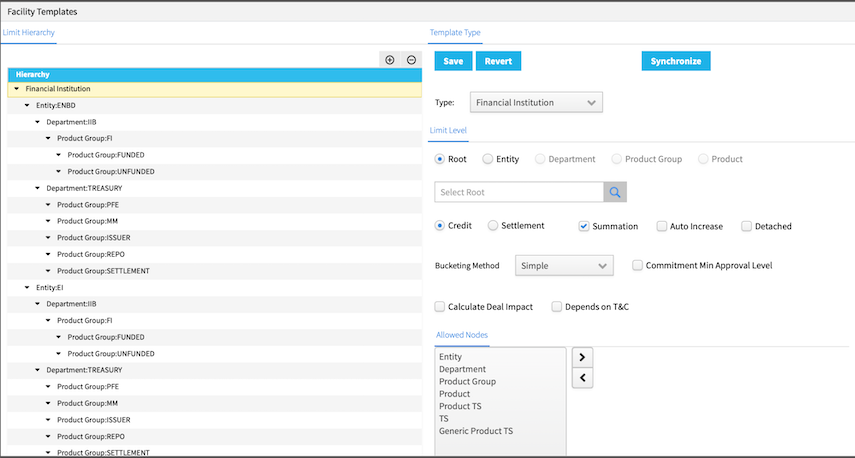

Globit RISQ FI offers flexible template management functionality that allows banks to reflect any complex organisational structure in the system. Some key features of the template management functionality include:

The Origination module enables stakeholders to contribute to the limit-setting process by sharing their limit needs and business drivers.

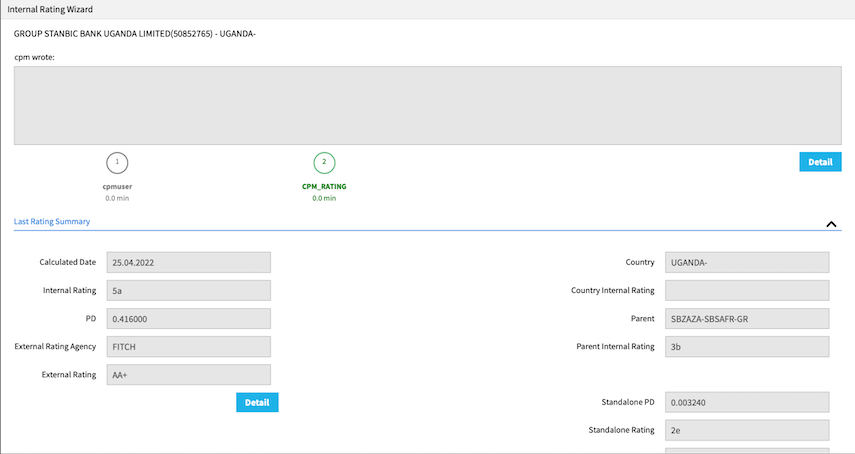

The Rating module enables users to configure bank or non-bank models in the system. Its key features also include:

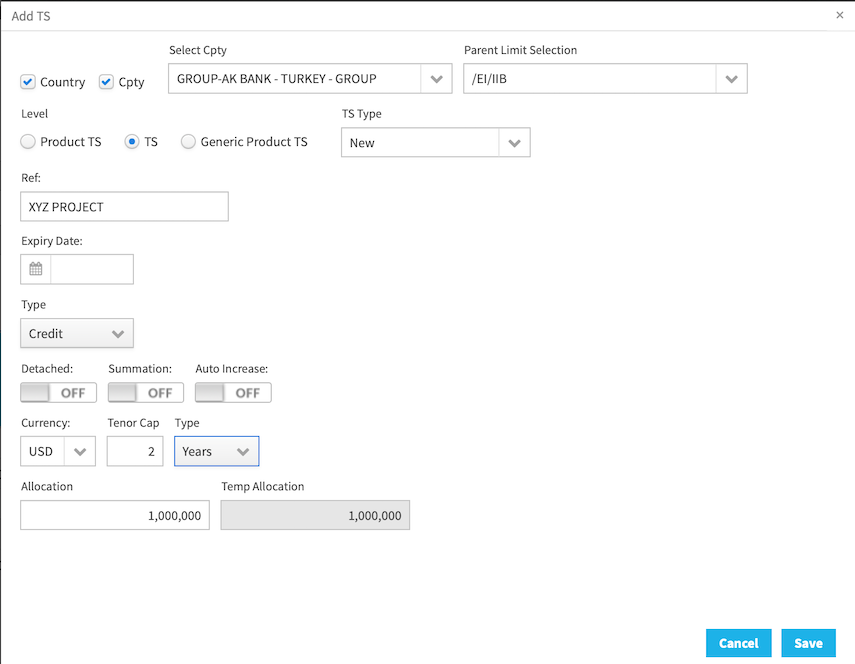

Globit RISQ FI allows banks to enhance standard limit structures defined via templates with transaction-specific limits. It also gives flexibility for limit allocation, such as:

Globit RISQ FI provides a comprehensive transaction management feature that includes reservation requests, commitment requests, RAROC engines, and risk transfers. These features enable financial institutions to manage their transactions efficiently while ensuring risk mitigation.

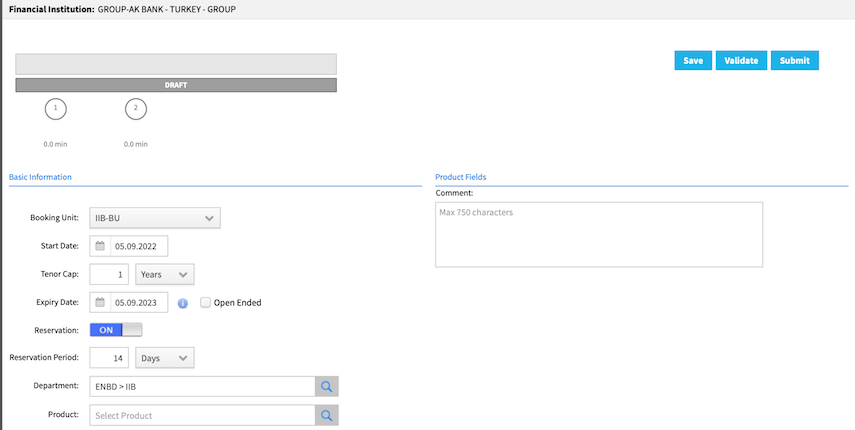

The Reservation Request function is a key aspect of Globit RISQ FI, which enables business units to request a reservation or earmarking of a limit via the application.

The duration of reservation or earmarking can be customised according to the requester’s needs, and limits are automatically released when the reservation expires, provided that the actual transaction did not take place.

In the event that the trade’s exposure exceeds the previously reserved amount, a secondary approval process may be required.

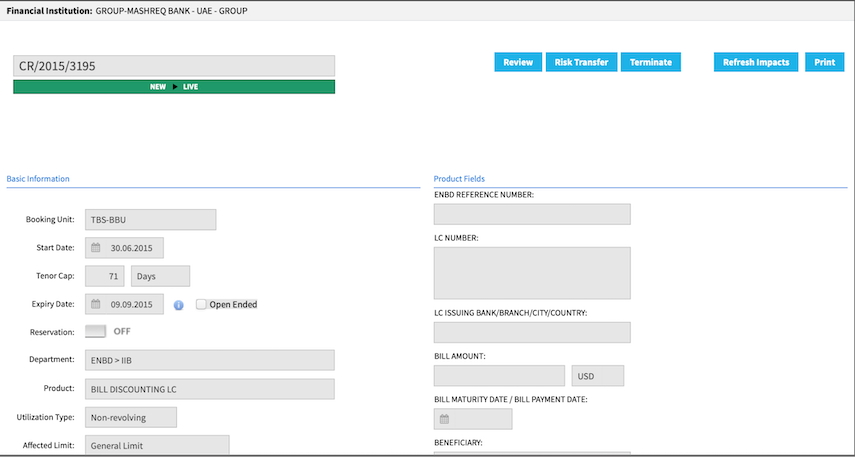

The Commitment Request function is another essential feature of Globit RISQ FI, which allows the FI team to reach a consensus for a transaction at the time of booking.

This functionality also allows for revolving or non-revolving commitments, which block the limit lines until the maturity date of the transaction. In the event of mismatches between the committed amounts and actual exposures, the system reports them as exceptions.

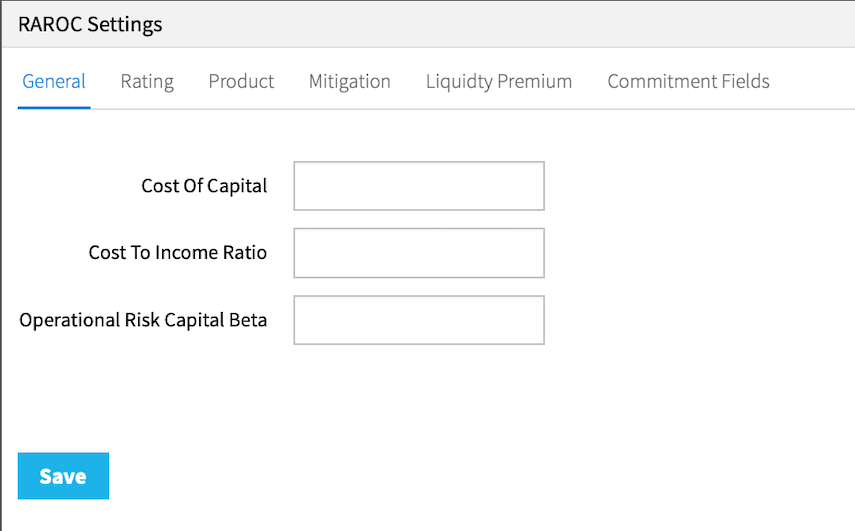

The RAROC engine is embedded within RISQ FI, which can be customised for each client according to their trade finance or correspondent banking requirements.

By capturing parameters in the system, the solution can calculate the RAROC value before the transaction is booked. Based on the RAROC calculation, approval might be enforced to be done with a higher authority, providing an additional layer of risk management.

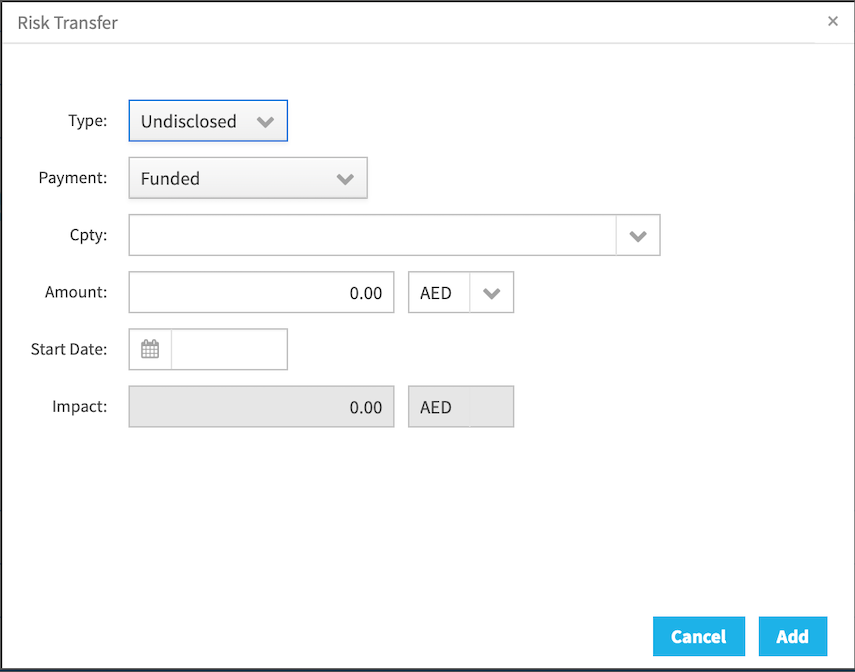

The Risk Transfer feature within Globit RISQ FI allows capturing the sell-downs of an asset to participating financial institutions. It supports funded/unfunded and disclosed/undisclosed risk transfers and can also work in an integrated manner with the optional Sell Down module.

The Exposure Management module includes a system capable of getting real-time exposures from downstream systems. It can be on a transaction basis or aggregated manner, especially for treasury limits.

Apart from the automated creation of exposures, it’s also possible to capture exposures manually, subject to a maker/checker check feature.

RISQ FI’s powerful Reporting module provides actionable insights into the FI business. The Reporting module comprises three sub-features, namely Interactive Reports, Report Scheduling, and Charts.

The set of Interactive Reports enables the user to filter and sort as easily as Microsoft Excel. Report filters can be stored for reuse, and reports can be exported to Excel. Reports can also be customised by hiding/showing columns.

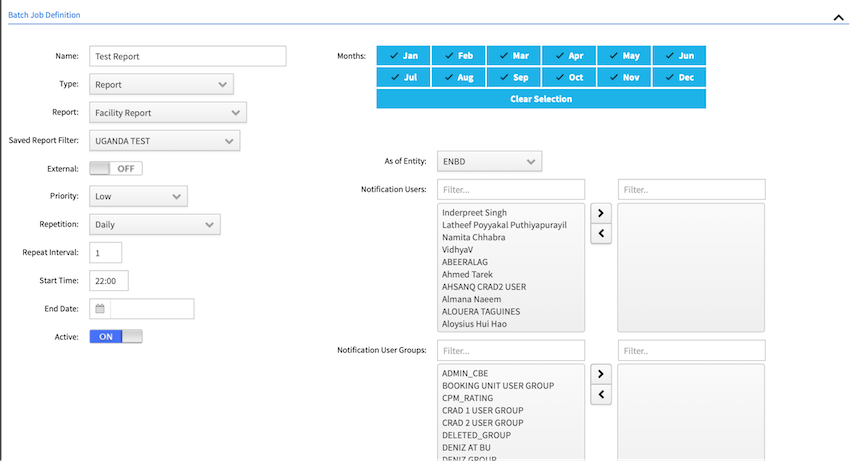

Any report in the system can be scheduled using saved parameter sets, and report results can be sent to the respective users via email.

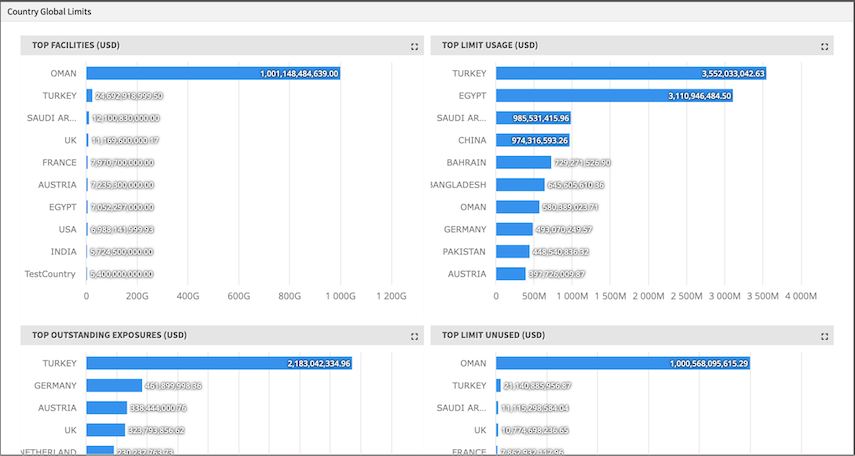

The system has a set of standard charts that visualise the FI business from various angles, such as allocation, usage, exposure, and more. These charts help users understand complex data and provide insights that drive better decision-making.

It is evident that correspondent banks must enhance their financial operations by adopting future-proof trade finance or correspondent banking solutions to remain competitive and adapt to digital transformation through data-driven decisions.

With over 23 years of experience in building, implementing, and supporting treasury IT solutions, we offer our partners parametric and flexible real-time treasury solutions that can be seamlessly implemented without the need for extensive professional services.

If you require expert support to streamline your financial operations within a matter of weeks, our team is equipped to provide you with a free consultation.