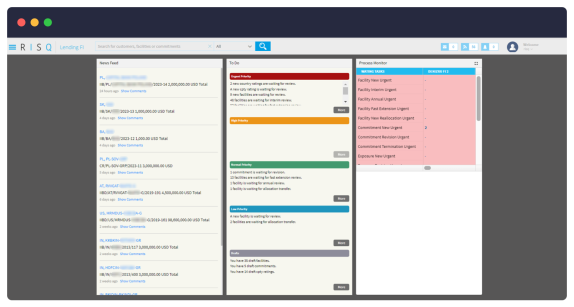

RISQ Financial Institutions

Unlock Full Control, Efficiency & Transparency in FI Operations

Globit’s RISQ FI enables financial institutions to manage all FI & sovereign credit lines in one place. Meet the ultimate FI solution join the market addressing all the needs of financial institution divisions for almost a decade.